Your Fee free atm for cash app images are ready. Fee free atm for cash app are a topic that is being searched for and liked by netizens today. You can Download the Fee free atm for cash app files here. Get all royalty-free vectors.

If you’re looking for fee free atm for cash app pictures information related to the fee free atm for cash app topic, you have come to the right site. Our site always gives you suggestions for refferencing the maximum quality video and picture content, please kindly hunt and find more enlightening video articles and images that match your interests.

Fee Free Atm For Cash App. As a consumer, you gain access to the allpoint. Despite offering the service for free when it first started, cash app does charge a $2 fee per every atm withdrawal transaction. The amount of money you can withdraw at an atm is also limited. Payment service, so it isn’t a solution if you’re trying to send money to friends and family across.

Pin on smart savings From pinterest.com

Pin on smart savings From pinterest.com

Viewing + changing your atm / cash back limit preferences. To find the nearest atm, visit the locations section of usbank.com or use the u.s. Please refer to your card fee schedule. Cash app instantly reimburses atm fees, including atm operator fees, for customers who get $300 (or more) in paychecks directly deposited into their cash app each month. Cash app instantly reimburses atm fees, including atm operator fees, for customers who get $300 (or more) in paychecks directly deposited into their cash app each month. Instapay send (bank to bank transfer) from banks where there is no fee 3.

Bank customer, you also have access to transact at moneypass network atms without a surcharge fee.

Once you have successfully activated free atm withdrawals, each qualifying deposit you receive after that will add an additional 31 days of atm fee reimbursements. Green dot® network cash reload fees and limits apply. You can never have too many options. It’s your money and you’re going to have to fight to keep more of it in your wallet. There is a maximum atm / cash back withdraw limit of $3,000.00 / month total from the branch card. Bank atms or partner atms.

Source: pinterest.com

Source: pinterest.com

Cash app users who use their cash app cash card to withdraw at any given atm are charged a fee of $2. However, there’s no fee to send money from your cash app balance or bank account, even if you send money to someone in the u.k. Standard transfers on the app to your bank account take two to three days and are free, while instant transfers include a 1.5% fee. 8 simply use your porte debit card for $0 fee withdrawals. Cash app users who use their cash app cash card to withdraw at any given atm are charged a fee of $2.

Source: in.pinterest.com

Source: in.pinterest.com

Green dot® network cash reload fees and limits apply. Standard transfers on the app to your bank account take two to three days and are free, while instant transfers include a 1.5% fee. Cash app charges a 3% fee when paying by credit card and a 1.5% fee for instant transfers. Instapay send (bank to bank transfer) from banks where there is no fee 3. Viewing + changing your atm / cash back limit preferences.

Source: pinterest.com

Source: pinterest.com

Your bank’s atm should be free for you to use, but customers from other banks most likely have to pay fees at the same machines. Say no to ridiculous atm fees, and yes to free withdrawals. As we mentioned above, you can send money across the pond with cash app, though it’s mainly a u.s. With current, you can bank with no atm fees and instantly find a location near you on the atm locator map in our app. Cash app users who use their cash app cash card to withdraw at any given atm are charged a fee of $2.

Source: pinterest.com

Source: pinterest.com

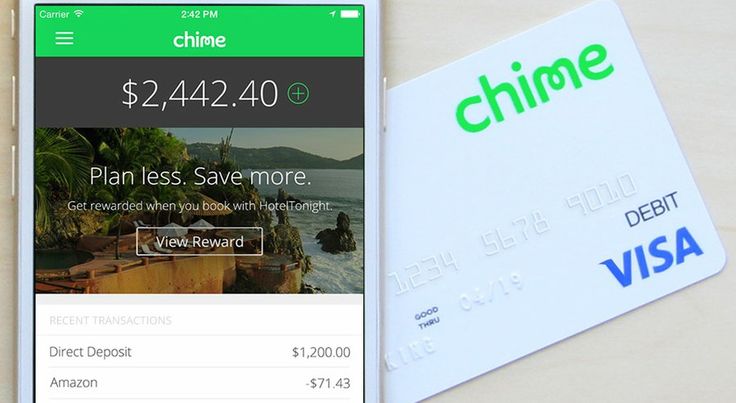

There is a maximum atm / cash back withdraw limit of $400 / day total from the branch card. Cash app users who receive qualifying direct deposits that total up to $300 plus get reimbursed for every 3 atm withdrawals per 31 days or a full month. However, there’s no fee to send money from your cash app balance or bank account, even if you send money to someone in the u.k. Please refer to your card fee schedule. Other online banks such as simple or chime have great options for atm usage.

Source: pinterest.com

Source: pinterest.com

Bank atms or partner atms. Cash app charges a 3% fee if you send money from a credit card. For overdraft, transaction is declined and no fee is charged. Atm.com® is a free service with no monthly or annual fee for either our web services or mobile app, and helps you earn both active and passive income as dividends (as defined below, data dating dividends, reward dividends, and the colony data dividends are collectively referred to as “dividends”) in numerous ways, without atm.com selling your personal information (our limited rights to share your. However, there’s no fee to send money from your cash app balance or bank account, even if you send money to someone in the u.k.

Source: pinterest.com

Source: pinterest.com

As a consumer, you gain access to the allpoint. As we mentioned above, you can send money across the pond with cash app, though it’s mainly a u.s. Bank customer, you also have access to transact at moneypass network atms without a surcharge fee. With current, you can bank with no atm fees and instantly find a location near you on the atm locator map in our app. Cash app users who receive qualifying direct deposits that total up to $300 plus get reimbursed for every 3 atm withdrawals per 31 days or a full month.

Source: pinterest.com

Source: pinterest.com

Please refer to your card fee schedule. 2 it�s easy to find moneypass atms in your area. There is a maximum atm / cash back withdraw limit of $3,000.00 / month total from the branch card. Unfortunately, there is no free mobile app option. The amount of money you can withdraw at an atm is also limited.

Source: pinterest.com

Source: pinterest.com

It’s your money and you’re going to have to fight to keep more of it in your wallet. There is a maximum atm / cash back withdraw limit of $400 / day total from the branch card. Unfortunately, there is no free mobile app option. Bank atms or partner atms. Visit business insider�s homepage for more stories.

Source: pinterest.com

Source: pinterest.com

Cash app charges a 3% fee when paying by credit card and a 1.5% fee for instant transfers. Instapay send (bank to bank transfer) from banks where there is no fee 3. Cash app instantly reimburses atm fees, including atm operator fees, for customers who get $300 (or more) in paychecks directly deposited into their cash app each month. You can never have too many options. There is a maximum atm / cash back withdraw limit of $400 / day total from the branch card.

Source: pinterest.com

Source: pinterest.com

Cash app fees can often be avoided by choosing the slower option and by never paying by credit card. The simplest solution is to visit your bank or credit union when you need to withdraw cash, although that’s not always the most convenient option. Standard transfers on the app to your bank account take two to three days and are free, while instant transfers include a 1.5% fee. Cash app users who use their cash app cash card to withdraw at any given atm are charged a fee of $2. Other fees apply to the bank account.

Source: pinterest.com

Source: pinterest.com

Cash app instantly reimburses atm fees, including atm operator fees, for customers who get $300 (or more) in paychecks directly deposited into their cash app each month. Despite offering the service for free when it first started, cash app does charge a $2 fee per every atm withdrawal transaction. As we mentioned above, you can send money across the pond with cash app, though it’s mainly a u.s. Cash app fees can often be avoided by choosing the slower option and by never paying by credit card. Visit business insider�s homepage for more stories.

Source: pinterest.com

Source: pinterest.com

With current, you can bank with no atm fees and instantly find a location near you on the atm locator map in our app. Your bank’s atm should be free for you to use, but customers from other banks most likely have to pay fees at the same machines. You can never have too many options. Payment service, so it isn’t a solution if you’re trying to send money to friends and family across. Find it in your porte app.

Source: pinterest.com

Source: pinterest.com

Despite offering the service for free when it first started, cash app does charge a $2 fee per every atm withdrawal transaction. It’s your money and you’re going to have to fight to keep more of it in your wallet. Cash cards work at any atm, with just a $2 fee charged by cash app. Green dot® network cash reload fees and limits apply. Despite offering the service for free when it first started, cash app does charge a $2 fee per every atm withdrawal transaction.

Source: pinterest.com

Source: pinterest.com

Please refer to your card fee schedule. Cash app charges a 3% fee when paying by credit card and a 1.5% fee for instant transfers. Neither green dot bank nor stash offers overdraft services. Say no to ridiculous atm fees, and yes to free withdrawals. However, there’s no fee to send money from your cash app balance or bank account, even if you send money to someone in the u.k.

Source: pinterest.com

Source: pinterest.com

Atm fees on cash card. There is a maximum atm / cash back withdraw limit of $400 / day total from the branch card. The simplest solution is to visit your bank or credit union when you need to withdraw cash, although that’s not always the most convenient option. Atm fees on cash card. 8 simply use your porte debit card for $0 fee withdrawals.

Source: pinterest.com

Source: pinterest.com

Cash app charges a 3% fee if you send money from a credit card. Visit business insider�s homepage for more stories. 2 it�s easy to find moneypass atms in your area. Other online banks such as simple or chime have great options for atm usage. 8 simply use your porte debit card for $0 fee withdrawals.

Source: pinterest.com

Source: pinterest.com

As a consumer, you gain access to the allpoint. Viewing + changing your atm / cash back limit preferences. 2 it�s easy to find moneypass atms in your area. Other online banks such as simple or chime have great options for atm usage. Atm fees on cash card.

Source: pinterest.com

Source: pinterest.com

You can never have too many options. There is a maximum atm / cash back withdraw limit of $3,000.00 / month total from the branch card. 2 it�s easy to find moneypass atms in your area. Payment service, so it isn’t a solution if you’re trying to send money to friends and family across. Other fees apply to the bank account.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fee free atm for cash app by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.